All your French VAT Compliance needs

Register for VAT, Transfer VAT agent, Fiscal Representation, VAT Refunds. Everything you need to keep your business running in France.

Super Responsive

We promise to reply to every client within 24hrs

Unlimited Support

Unlimited help without any restrictions

Simple Pricing

1 fee per year and everything is included

Experienced Team

You speak to our most knowledgeable staff

The solution to your VAT problems is just a click away

VAT Registration

VAT Transfer

Fiscal

Representation

VAT

Refunds

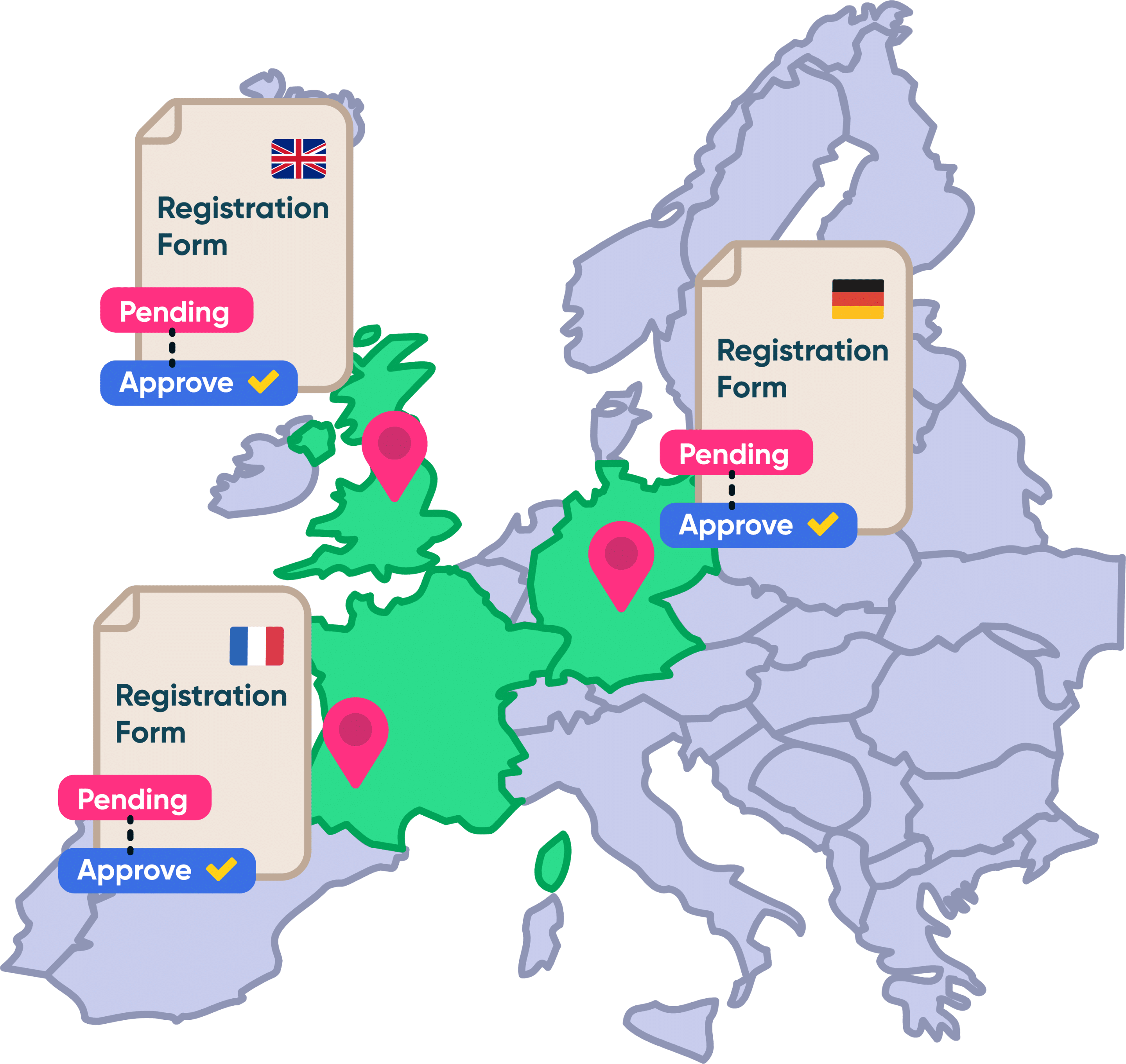

VAT Registration

Unlock your sales potential with our bespoke VAT registration services. Our team is ready to identify your VAT obligations allowing your business to expand across the world with a dedicated team beside you.

Leave the complexities to us, our professional team provide a seamlessly fast registration service and help you keep on top of the various filing deadlines so you can keep on top of what matters most.

fiscal representation

VAT Digital is a recognised and certified European Fiscal Representative allowing for our non-EU clients to trade freely with the EU. This enables a lot of benefits for businesses when registering and importing goods to the European Union.

VAT refunds

VAT Digitals specialist team can help identify where VAT can be recovered and process a reclaim to ensure your business is maximizing its profits.

Any size, any platform

VAT Digital can help any size business on any e-commerce platform keep on top of their VAT compliance.

A Dedicated Team

A professional team ready to help your business grow in France with offices in 5 countries worldwide.

Client Reviews

Hear from 1000's of happy customers

Hayley, Soterra Limited

★ ★ ★ ★ ★

We have used VAT Digital now for 4 years and they have been instrumental in helping us build our business. They are always helpful as well as prompt to answer any queries and with a wealth of knowledge. I would have no hesitation in recommending them.

Jess, Crumbs and Doilies

★ ★ ★ ★ ★

As a small business I found navigating how to register for IOSS incredibly daunting and confusing until I found VAT Digital. VAT Digital enabled my understanding, provided excellent advice and the onboarding process was simple. I would highly recommend VAT Digital and their services

Tony, Eglo UK

★ ★ ★ ★ ★

I use VAT Digital as our agent for VAT in both Germany and Ireland – including setting us up in Ireland. The service we receive is always first class – including timely reminders to submit data when necessary. Whenever I’ve had queries on the correct treatment of particular items they are always answered promptly and in detail.

Tarun, Basaho

★ ★ ★ ★ ★

Efficient and streamlined service

I've been using VAT digital for 3 years now for all my EU VAT filings. I was with a bigger firm before them and I am very satisfied with the switch. They are very helpful, responsive (this was a major requirement for me) and accurate. Their prices are in line with the market or a little lower. Recommended!

FREE VAT Consultation

Trust VAT Digital to handle your VAT Registrations & Filings across Europe with our exceptional service and communication.