One Registration, 27 EU Markets

Any size business, any selling platform. VAT Digital has the solution to help you stay VAT compliant.

Free

Consultation

No hidden charges for the extra help

Dedicated VAT Experts

We know the rules, so you don’t have to worry

Direct Personal Service

Always available when you need us

Deadline Management

Keeping you compliant, every month

1 Language, 1 Return, 1 Payment

The One Stop Shop is a VAT simplification scheme which can be used to report goods and services sold to individuals within the 27 european countries with a single registration.

1

Register for the

One Stop Shop

Register for the OSS scheme in the EU country where you hold a fulfillment centre and VAT registration.

2

Sell instantly to 27 EU Countries

Apply the applicable EU Country VAT rate at your checkout and begin selling to millions of customers with a single registration.

3

File and

Pay

Report your sales on one return every quarter and make 1 payment for all of the VAT due.

Types of one stop shop

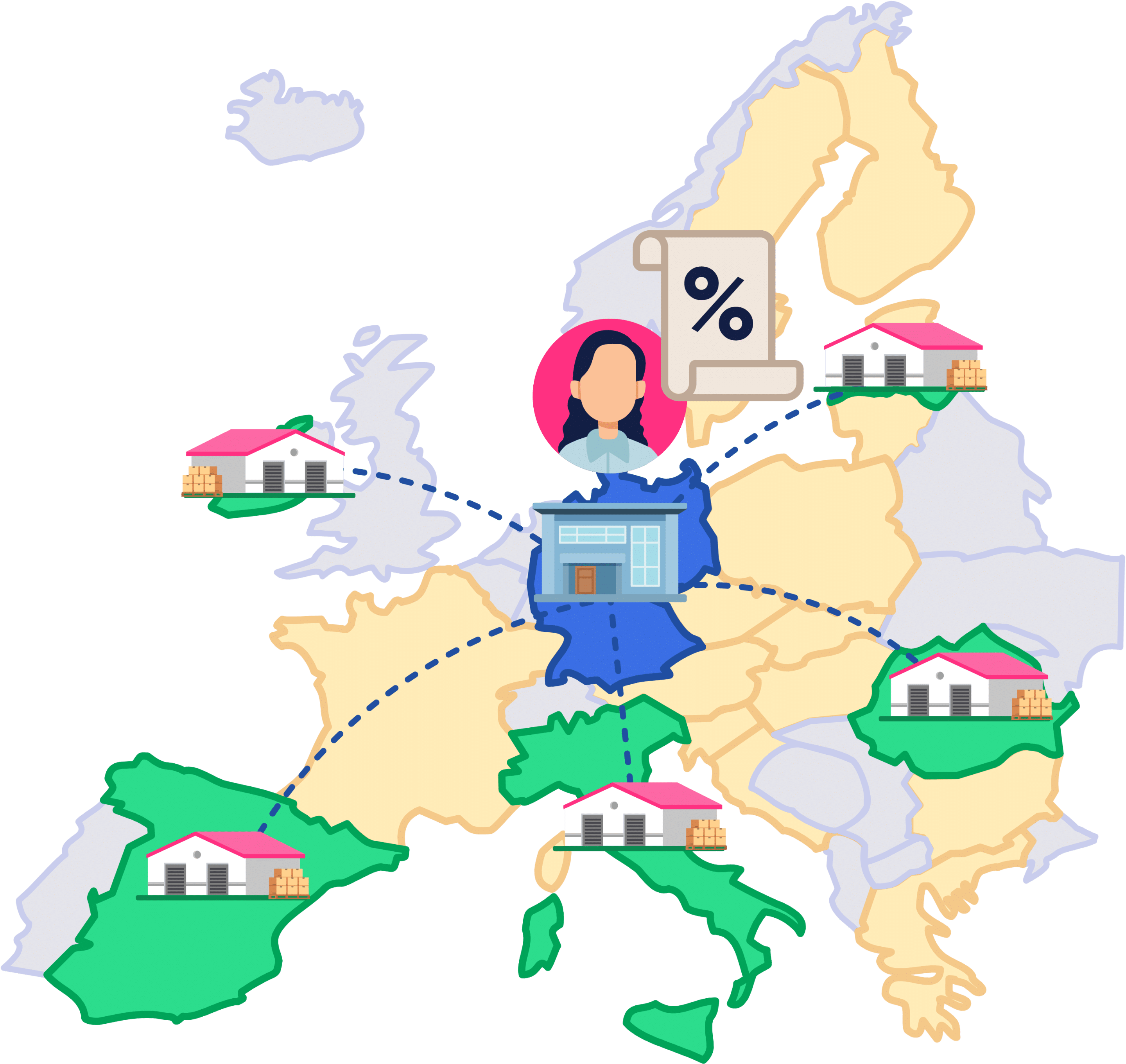

Union

If you are an EU business you can apply for the Union scheme using your local VAT number giving you the ability to report sales of goods and services in one return.

The One Stop Shop VAT return would report all the distance sales of goods and services by the European company to consumers in other EU countries replacing the EU-wide distance sales threshold

Non-Union

For a non-EU business storing in an EU country you would need a VAT number to apply for OSS in that country, you can then report distance sales of goods only in the OSS return.

A Non-EU company selling services would be required to register for the non-union OSS however if they sell goods and services they would require both Union and non-union OSS and be required to submit two One Stop Shop VAT returns quarterly.

Your Questions Answered

Do i need a VAT number to use OSS?

If you are storing goods in an EU country and intend to use the Union scheme then you do need a VAT number. If you are a non-EU country you can use the Non-union scheme without a VAT number to report digital services only

Is there a transaction value limit?

Unlike IOSS there is no value limit on the products you sell through the OSS scheme

Can I sell to businesses?

The OSS scheme does not allow sales to businesses, this can however be done through your VAT return linked to your OSS

What are the filing deadlines of OSS?

The OSS is filed every quarter regardless of country of registration and must be filed with VAT also paid no later than the last day of the month after the quarterly period.

Client Reviews

Hear from 1000’s of happy customers

Hayley, Soterra Limited

★ ★ ★ ★ ★

We have used VAT Digital now for 4 years and they have been instrumental in helping us build our business. They are always helpful as well as prompt to answer any queries and with a wealth of knowledge. I would have no hesitation in recommending them.

Jess, Crumbs and Doilies

★ ★ ★ ★ ★

As a small business I found navigating how to register for IOSS incredibly daunting and confusing until I found VAT Digital. VAT Digital enabled my understanding, provided excellent advice and the onboarding process was simple. I would highly recommend VAT Digital and their services

Tony, Eglo UK

★ ★ ★ ★ ★

I use VAT Digital as our agent for VAT in both Germany and Ireland – including setting us up in Ireland. The service we receive is always first class – including timely reminders to submit data when necessary. Whenever I’ve had queries on the correct treatment of particular items they are always answered promptly and in detail.

Tarun, Basaho

★ ★ ★ ★ ★

Efficient and streamlined service

I’ve been using VAT digital for 3 years now for all my EU VAT filings. I was with a bigger firm before them and I am very satisfied with the switch. They are very helpful, responsive (this was a major requirement for me) and accurate. Their prices are in line with the market or a little lower. Recommended!

FREE VAT Consultation

Trust VAT Digital to handle your VAT Registrations & Filings across Europe with our exceptional service and communication.