Register for VAT the easy way and accelerate your EU Sales

Any size business, any selling platform. VAT Digital has the solution to help you stay VAT compliant.

Free

Consultation

No hidden charges for the extra help

Dedicated VAT Experts

We know the rules, so you don’t have to worry

Direct Personal Service

Always available when you need us

Deadline Management

Keeping you compliant, every month

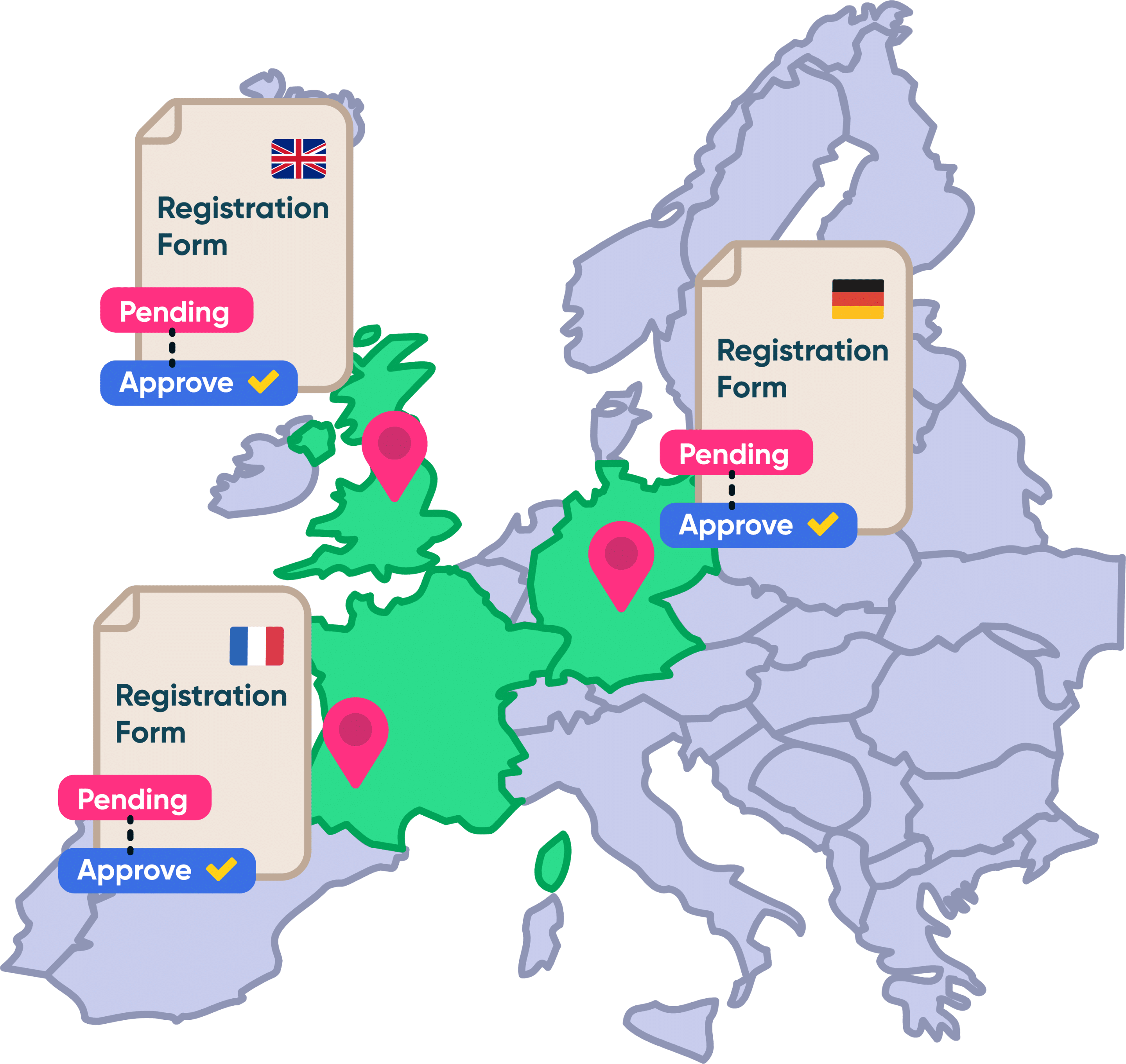

Hassle free EU VAT Registration

1

Find a solution for your business

Arrange a completely free consultation with our VAT team to find the correct solution for your business.

Sign-up to our services and start your VAT registration.

Get your VAT number and start our onboarding process to understand your obligations and deadlines with your account manager.

2

File on-time,

every time

Receive prompt reminders to provide data for completing your filing compliance in every registered country.

Let our team calculate your VAT liability in each jurisdiction and file your return on time.

3

File and

Pay

Receive detailed instructions on where and how to pay with the correct references so everything is accounted for

One Price. Exceptional Service. Price Guaranteed

See how we compare

* Additional charges may apply when an audit is triggered

Your Questions Answered

Do I need a VAT Number?

If you’re selling abroad the simple answer would be Yes. Many activities can trigger the need for a VAT registration. Some of the main activities include; Storage, Selling to Consumers, Importing, Supply & Installation.

How long does it take to get a VAT number?

The length of time to get a VAT number is very country specific, each with their own process and requirements. Appointing an agent can help speed up this process, saving both time and money.

Can I sell without a VAT number?

It is possible to sell without a VAT number but not advised. Reverse-charge rules may apply instead and you do have the ability to back-date your VAT registration in some countries however late registration penalties as well as late filing and VAT payment fines may apply.

When do I file a VAT return?

Each country or scheme has their own reporting deadlines. These can range from Monthly, Bi-monthly, Quarterly or Yearly. If you are registered in multiple countries you will have multiple deadlines to meet for both reporting and paying VAT. That’s why VAT Digital are here to help and keep on top of your VAT compliance.

Do I need a Fiscal Representative to register?

Some EU countries require a Fiscal Representative to be appointed when a non-European business wishes to register for VAT and others don’t. Norway, Japan and UK businesses are usually exempt from this requirement due to trade agreements with the EU. If you are a non-EU company you typically cannot register directly with the tax office and must use a representative.

How do i pay my VAT?

The VAT owed for the filing period can be paid directly to the tax office details using a unique reference. Some authorities will require a direct debit to be set-up to avoid additional bank fees.

Businesses registered through a Fiscal Representative will have to pay VAT to their representative directly.

Client Reviews

Hear from 1000’s of happy customers

Hayley, Soterra Limited

★ ★ ★ ★ ★

We have used VAT Digital now for 4 years and they have been instrumental in helping us build our business. They are always helpful as well as prompt to answer any queries and with a wealth of knowledge. I would have no hesitation in recommending them.

Jess, Crumbs and Doilies

★ ★ ★ ★ ★

As a small business I found navigating how to register for IOSS incredibly daunting and confusing until I found VAT Digital. VAT Digital enabled my understanding, provided excellent advice and the onboarding process was simple. I would highly recommend VAT Digital and their services

Tony, Eglo UK

★ ★ ★ ★ ★

I use VAT Digital as our agent for VAT in both Germany and Ireland – including setting us up in Ireland. The service we receive is always first class – including timely reminders to submit data when necessary. Whenever I’ve had queries on the correct treatment of particular items they are always answered promptly and in detail.

Tarun, Basaho

★ ★ ★ ★ ★

Efficient and streamlined service

I’ve been using VAT digital for 3 years now for all my EU VAT filings. I was with a bigger firm before them and I am very satisfied with the switch. They are very helpful, responsive (this was a major requirement for me) and accurate. Their prices are in line with the market or a little lower. Recommended!

FREE VAT Consultation

Trust VAT Digital to handle your VAT Registrations & Filings across Europe with our exceptional service and communication.