The year 2021 brings an overhaul of changes for VAT in Europe and the UK. The UK leaving the EU on January 1st 2021 has seen all businesses on both sides of the border adapt to new customs changes between the communities along with new UK rules to combat VAT fraud similar to those being introduced in the EU in July 2021.

At the same time, everybody has been affected by the global pandemic and trading has seen a huge shift from traditional physical stores to online shopping, creating a boost in terms of growth in online e-commerce.

From 1st July 2021, all businesses will be affected by the new rules when trading in Europe as the EU introduce their new VAT e-Commerce package.

What is changing after July 1st 2021?

The overview of changes taking place after July 1st are:

- Removal of the distance selling thresholds for sales of goods and the introduction of a new unified EU-wide threshold of 10,000 euros

- Making marketplaces the deemed supplier for goods sold on their platform in order to combat fraud by collecting and reporting VAT on behalf of the seller

- New record-keeping requirements for online marketplaces facilitating the supply of goods and services

- Removal of the 22 EUR low value consignment rate for import VAT and introducing the new Import One Stop Shop (IOSS)

- Special arrangements to simplify the import of goods with a value of less than 150 EUR where the Import One Stop Shop (IOSS) is not used

- Expanding the Mini One Stop Shop (MOSS) by launching the new One Stop Shop (OSS) scheme

What is the reason for the changes?

The changes are to combat VAT fraud and create a level playing field for all sellers. The introduction of the new OSS and IOSS schemes will help reduce the costs of VAT compliance for sellers and by charging VAT at destination, this allows for a smoother delivery process into the EU with the removal of import vat.

By introducing the new 150 EUR threshold, businesses from non-eu countries will no longer benefit from the import vat exemption on goods under 22 EUR, creating a fairer market.

Finally; it is predicted that the new rules will see EU member states gain an increase in VAT revenues of around EUR 7 Billion Annually.

Who will be affected by these changes?

eCommerce changes in detail:

Distance Selling Thresholds

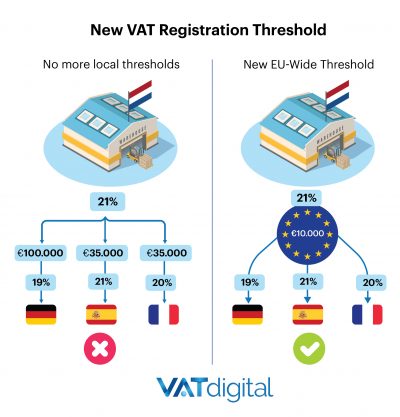

From 1st July 2021, a new threshold will be introduced in the EU and the old country-specific distance selling thresholds will be replaced by a new EU wide threshold. The threshold will apply to B2C distance sales made cross-border to other EU countries; it does not include domestic sales.

In the past, each country had a different distance selling threshold, for example France was €35,000 and Germany €100,000, which made things complicated for tax offices and sellers to manage.

The new EU wide threshold of €10,000 EUR will now apply from 1st July. Most sellers are already conducting distance sales in Europe and may have already exceeded this. This creates complications and means potentially high compliance fees. For example, if you store goods in France and have a French VAT registration number and ship to 5 other EU countries, you would now have to open up 5 new VAT registrations in these destination countries. To avoid the need for multiple additional VAT registrations in Europe, a new One Stop Shop (OSS) scheme was introduced which allows you to report all of the VAT at destination in 1 single VAT return.

One Stop Shop (OSS)

One of the largest changes to be introduced will be the expansion of the Mini One Stop Shop (MOSS) to the One Stop Shop (OSS) for goods and services. The expansion into OSS extends the use to all B2C services and also covers distance sales of goods within the European community and certain domestic supplies of goods facilitated by online marketplaces (OMP’s)

- Businesses will benefit from selling goods and services within the EU by only registering for VAT in one member state instead of requiring multiple registrations

- Businesses will benefit from a single line of communication with the Tax Authority in the member state of establishment

- The OSS will allow for a single VAT declaration and single payment for all of the goods sold and services carried out in other EU Member States

- This greatly reduces the need for VAT registrations in other member states and means a simplified procedure for sellers.

Import One Stop Shop (IOSS)

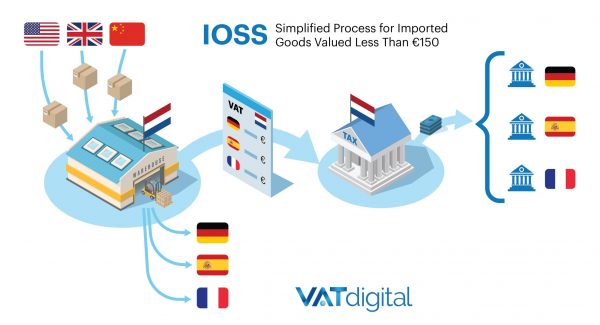

The €22 low consignment relief for goods entering the EU will be abolished and replaced by a new 150 EUR threshold facilitated by the new Import One Stop Shop (IOSS).

The Import One Stop Shop is a portal similar to the OSS which businesses can register for in order to comply with their VAT obligations on sales of goods imported into the EU. The IOSS will be available from July 1st 2021 and it will allow both suppliers and electronic interfaces selling goods to EU buyers to collect, declare and pay vat to the tax authorities instead of making the end consumer pay vat upon import.

The scheme is to help combat VAT fraud in the EU and to simplify the process of collecting and declaring VAT for businesses. This will create fair competition for EU companies trying to compete with non-EU companies who were benefitting from zero import VAT. Consumers in the EU will also benefit by not being hit with additional charges on top of what is advertised on a seller’s website or marketplace.

How does the IOSS work?

The Import One Stop Shop can be used by companies who import goods from non-EU territories into the EU on a B2C basis and where the intrinsic value of the goods is under 150 EUR.

EU businesses will be able to apply for the IOSS directly in their home country and facilitate the declaration and payment themselves; whereas non-EU businesses will have to appoint an EU intermediary to facilitate the IOSS for them. In addition, online marketplaces can also apply for the IOSS and handle the VAT payments on behalf of sellers making sales on their platforms when the above conditions apply.

Once registration is complete, businesses will receive an IOSS VAT Number which will be used by postal operators and courier services when declaring the importation of goods through customs. Customs authorities will verify the number’s validity and the package will then be cleared and moved onto it’s final destination and no import VAT will need to be paid.

This should create a faster clearance at customs, leading to faster delivery to your customers in the EU.