It has been proposed by the European Commission (EC) that changes are to be made to the €150 import threshold from March 2028. This would see the current arrangement for shipments over the value removed, with shipments of all values receiving the same treatment of VAT charged at the purchase stage. Below are the main reforms of this proposal:

- VAT will be charged at checkout for ALL items, irrespective of their value. Currently, this is only actioned for consignments below €150.

- From January 2025, under the new ‘VAT in the Digital Age’ (ViDA) reforms, marketplaces will be liable for the VAT and Customs collection for consignments of all values, including those over €150. Currently, they only have this liability for those under €150.

- In turn, this will enable the IOSS system to be used to report sales of all values, where currently it is capped at €150.

By carrying out these reforms, the main benefit to businesses and consumers will be that the issue of double taxation on goods will not be possible. Under the current rules, there are occasional cases where the consumer is charged VAT at checkout, as the consignment is below the threshold, but then is taxed a second time at the border due to factors such as exchange rate taking the consignment over the €150 threshold. Under these new rules, all values of goods will be taxed at checkout, eliminating this possibility.

These proposals will be confirmed by the EC by 31st December 2027,confirming the laws, regulations and provisions with the proposal being active from as early as 1st March 2028.

Contact VAT Digital for help with your EU VAT compliance and more IOSS information

Ending the risk of double taxation for IOSS transactions

A sigh of relief for businesses who have had a rocky start with IOSS, with shipments being rejected or taxed at the customs border despite already charging VAT on their e-commerce sites. The removal of the €150 threshold allowing any value of goods to be shipped through a valid IOSS number will remove the majority of these issues and allow shipments to flow smoother.

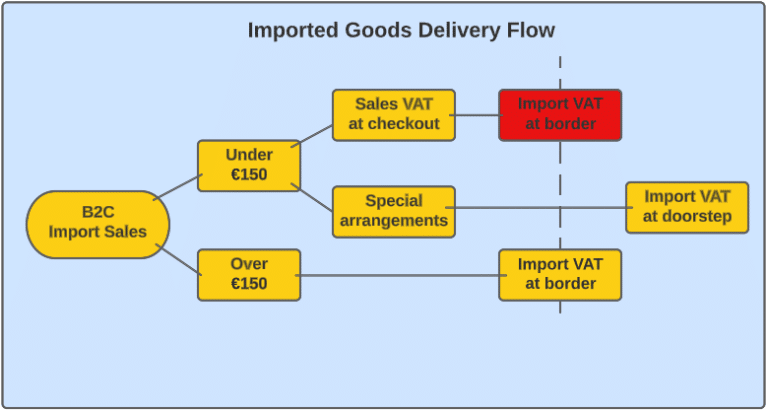

In the current regime any goods imported with a value above €150 follow normal customs procedure, and Import VAT is charged before delivery can be made and goods cleared at the border. For goods under €150 there are options to ship with or without an IOSS number, in many situations IOSS members are charging the sales VAT at checkout to their EU customers but also being charged import VAT at the border creating a double taxation as shown below.