International Commercial Terms – or Incoterms for short – are standard around the world, and were published by the International Chamber of Commerce (ICC) in order to prevent confusion during trades when setting out the obligations of buyers and sellers globally. A short-hand version of the incoterms are often used to help understand the exact arrangements of the transaction, including the method of transport used during shipment.

Incoterms came into force in 1936, and are often updated by the ICC to keep in line with the global changes in trade. The terms are standardized globally to ease with transactions and promote use of open markets. While the use of incoterms during trade is voluntary, the rules are commonly used by over 100 countries providing a universal set of rules and guidelines in a common language.

The Incoterms used can vary depending on the mode of transport used for the transaction, where as some can be used for all modes.

As of 2020, there are 11 incoterms, 7 of which can be used over any mode of transport. They set out who is responsible for organizing shipment, and when the liability moves over from seller to buyer in the transaction. In turn, this also determines who is liable for the VAT and duty on the transaction.

Terms for Any Mode of Transport:

EXW: Ex Words – the seller is only required to make the goods available for pick up at the seller’s business. The seller does not need to clear the goods for export, or load the goods onto any collecting vehicle.

FCA: Free Carrier – the seller delivers goods to the carrier who is nominated by the buyer. The place of delivery must be clearly stated, as this is the point at which the risk passes over to the buyer.

CPT: Carriage Paid to – The seller must pay all costs of carriage in order to bring the goods to a named destination. They nominate the carrier, and deliver the goods to them.

CIP: Carriage and Insurance Paid to – the seller has the same responsibility as CPT, however must also pay for insurance cover (only the minimum cover is required) for loss or damage to goods during shipping.

DAP: Delivered at Place – The seller is responsible for the shipping and goods until they are delivered to the buyer. The buyer is responsible for the unloading of the goods at the destination.

DPU: Delivered at Place Unloaded – DPU replaces the former DAT incoterm. The seller is responsible for delivery and unloading of the goods.

DDP: Delivered Duty Paid – The seller has full responsibility of the costs and risks involved with getting the goods to the destination, including clearing the goods for export and import, and paying any duty involved. The buyer is responsible for unloading the goods at the destination. From a VAT registration perspective, this is usually the incoterm where the seller is responsible and is required to VAT register in the country of importation for tax purposes.

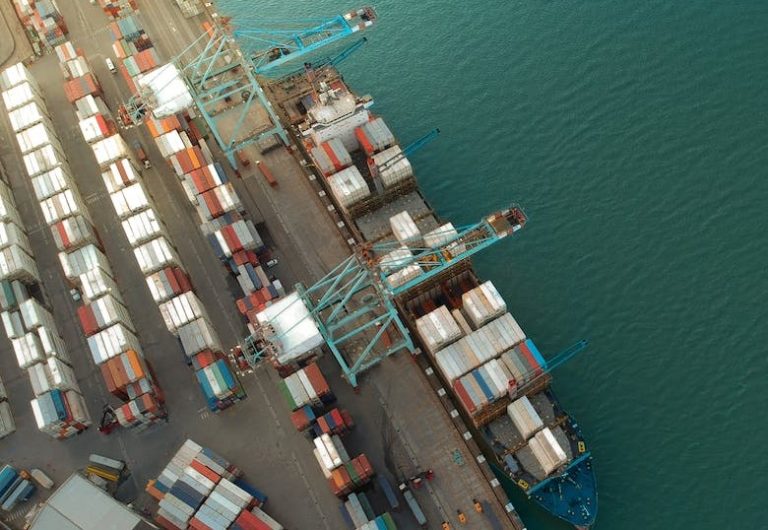

Terms for Sea and Inland Waterway Transport:

FAS: Free Alongside Ship – the seller’s responsibility ends once the goods are placed alongside the vessel transporting them. At this point any risk passes to the buyer. The transport by sea is organized by the buyer.

FOB: Free on Board – similar to FAS, however the seller has responsibility of the goods until they are places on the vessel, at which point all obligations fall to the buyer. The buyer also organises the transport by sea.

CFR: Cost and Freight – like FOB, the responsibility for loss or damage passed to the buyer once the goods are on board, however it is the seller who contracts and pays for the costs necessary to bring the goods to the destination port.

CIF: Cost, Inurance and Freight – The terms of CIF include all covered by CFR for when responsibity moved from seller to buyer, along with the seller also paying for insurance cover (only the minimum cover is needed) against the buyers loss or damage to goods during carriage.